Superannuation funds generally invest in assets that generate cash flow; for example, investments in property which provides a rental stream and potentially capital gains. Commodities do not generate cash flow, and this makes it more difficult to forecast their long-term expected returns. While less common, some superannuation funds also invest in commodities such as gold. However, most funds have indirect exposures to commodities through other areas of the portfolio, such as gold mining companies.

Commodities are physical products comprising of various sectors such as energy, metals, agriculture products and livestock that can be traded globally and play a key role in the economy. They are typically used as inputs in the production of goods and services, such as iron ore, which is used for steelmaking.

From an investment perspective, commodities are often traded via futures (an agreement to buy or sell the commodity at an agreed price in the future) for the purpose of seeking returns, diversifying the portfolio, or providing a hedge against inflation. The performance of commodities tends to be more volatile than equities and it is influenced by various factors, including economic growth, weather, climate change, environmental standards and geopolitical events. Commodities encompass a broad range of assets, but recently, copper and gold have garnered significant attention from investors.

- Copper is a fundamental component required for the green energy transition due to its high conductivity. It is a key input in renewable energy infrastructure, data centres, and electric vehicles. This positions copper to benefit in the medium to long term as the global economy increasingly relies on electrification.

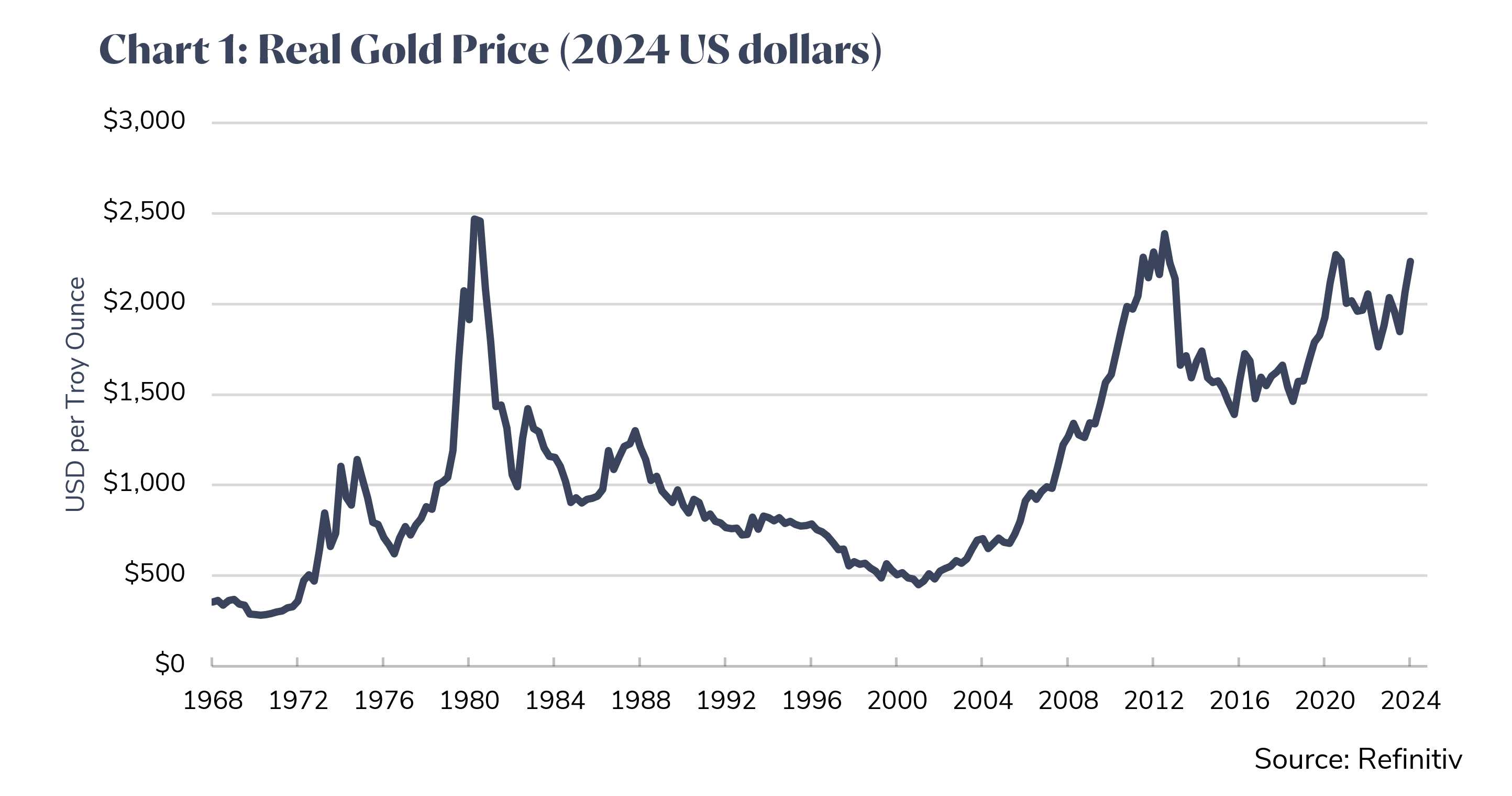

- Gold is often regarded as a safe-haven asset, often providing favourable returns during periods of economic turmoil or uncertainty. It has generally increased in real value over the long term (see chart below). Its demand is heavily influenced by real interest rates and central banks who buy and sell gold as part of managing their financial reserves. Gold can provide meaningful diversification benefits within a portfolio given its low correlation with other asset classes.

When a superannuation fund invests directly in commodities, it will typically do so through a broad-based exposure to a range of commodities. This is done to provide diversification given that the volatility of individual commodities can be very high and the long-term return outlook very uncertain, partly because of the lack of cash flows.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination.