Australia continues to experience high inflation, while some other developed countries, such as the United States, have started to experience falling inflation (from elevated levels). Inflation in Australia reached a multi-decade high of 7.8% over the year to the December quarter 2022. So far, the main driver of the increase in inflation has been rapid increases in non-labour input costs. While some leading indicators suggest that inflation in Australia has peaked, a key concern for the Reserve Bank of Australia (RBA) is the recent pick-up in nominal wage growth (before inflation is taken into account). This article briefly examines recent wage growth developments in that context.

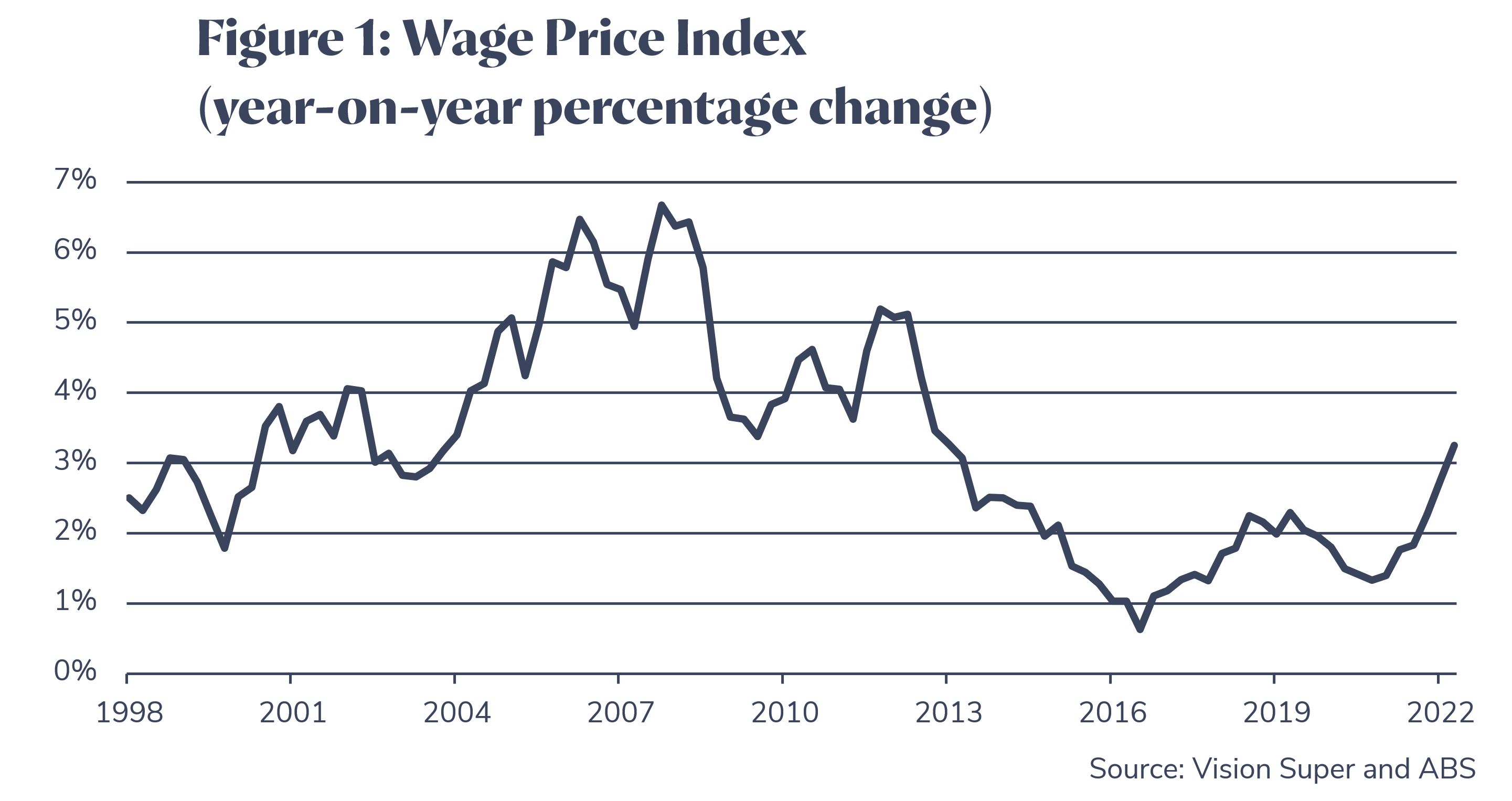

Figure 1 shows that, until recently, aggregate wage growth has been less than 3% for many years. Over recent quarters, wage growth has picked up and reached 3.3% on a year-on-year basis in the December quarter 2022. While the current level of wage growth is the highest in around a decade, it has risen from extremely low levels and is now broadly consistent with the RBA’s inflation target of 2% to 3%.

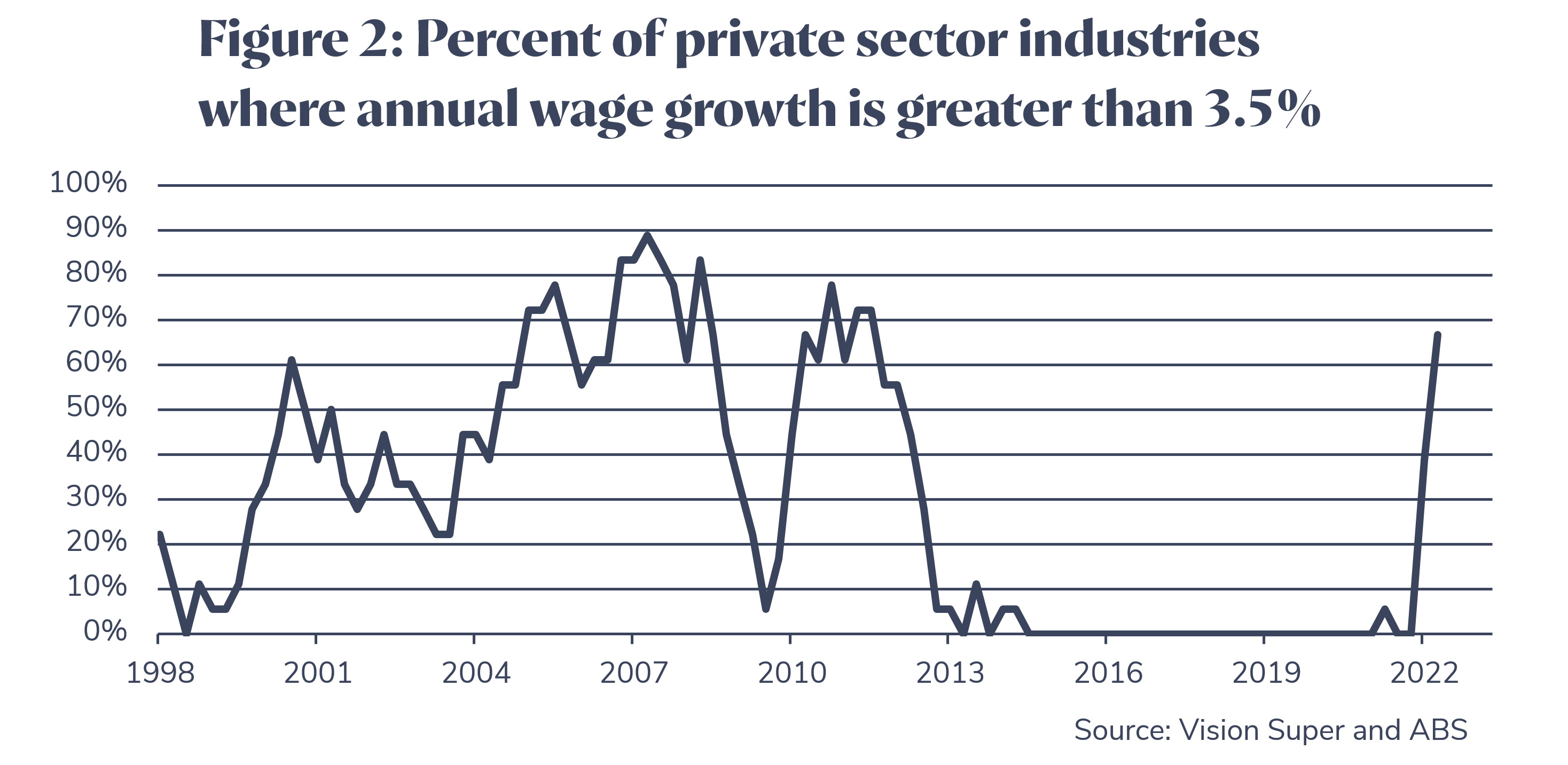

The current tight labour market may put further upward pressure on wage growth. For example, the unemployment rate is close to an historic low (at 3.7%) and there is an excess demand for labour, as evidenced by the high number of job vacancies per unemployed person. While nominal wage growth has been rising over recent quarters, it has not yet reached elevated levels. That said, the recent pick up has been broad-based, with two thirds of private sector industries experiencing over 3.5% growth in the December quarter 2022 (see Figure 2). For most of the post-GFC period, this proportion was less than 20%.

The RBA is concerned about further increases in wage growth that could result in inflation remaining above its target range. Reflecting this, the RBA is raising interest rates, with the aim of reducing inflation through restricting demand. The average worker has seen what their pay packet can buy shrink while their interest costs have gone up. The corporate world and overseas suppliers have not felt this impact to anywhere near the same extent. The market is currently pricing the RBA increasing the cash rate from its current level of 3.6% to a peak level of around 4% over coming months, which will cause more pain.

Wage growth over coming quarters is likely to be an important factor for determining the extent of interest rate increases by the RBA. Forward looking business surveys suggests that wage growth is likely to slow. A key risk for the Australian economy is that interest rate increases eventually result in a sharp slowdown and possibly a recession. While this is not our central case, we are monitoring the housing market closely for signs of stress which may provide an early indication of a significant slowdown.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination