During the month of March, three regional banks in the US failed; among them Silicon Valley Bank (SVB), which was the second-largest bank failure in US history. These events triggered some panic and volatility in the market, reflecting less confidence in the US banking system. The concerns were not limited to the US but has also affected other parts of the globe, with Credit Suisse, a major European investment bank, being purchased by UBS.

There were a few specific aspects of the US banks that failed. For example, SVB had a technology-concentrated client base, a large proportion of uninsured deposits and a large holding of long maturity bonds. The fragilities of the banks that failed were exposed by the very rapid increase in interest rates that has occurred over the past year.

While the US banks that failed represented only a small proportion of US banking assets, their failure had the potential to materially undermine confidence in the US banking system. This is because their failure resulted in more people becoming aware of some concerning aspects of the banking system. In particular:

- Deposits are only insured up to USD250,000.

- Some of the US banks have material losses that are not fully reflected in their balance sheets.

- Money market funds provide much higher rates of interest than the banks, meaning that there is an incentive to move money into such funds at the expense of bank deposits.

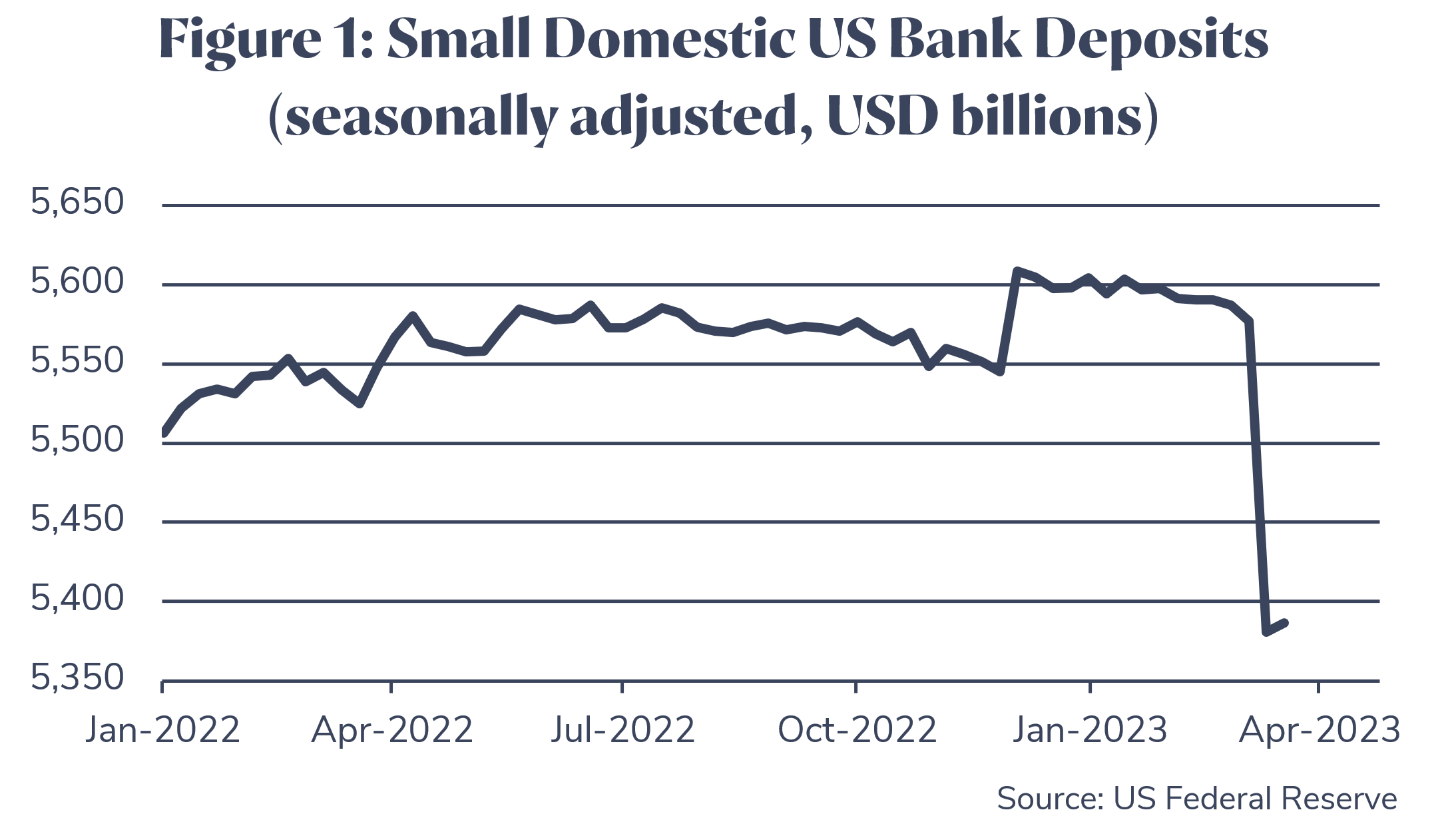

Some depositors have become worried about the resilience and stability of banks, especially small US domestic banks with weaker balance sheets. Figure 1 shows that deposits for small US banks have declined rapidly over recent weeks.

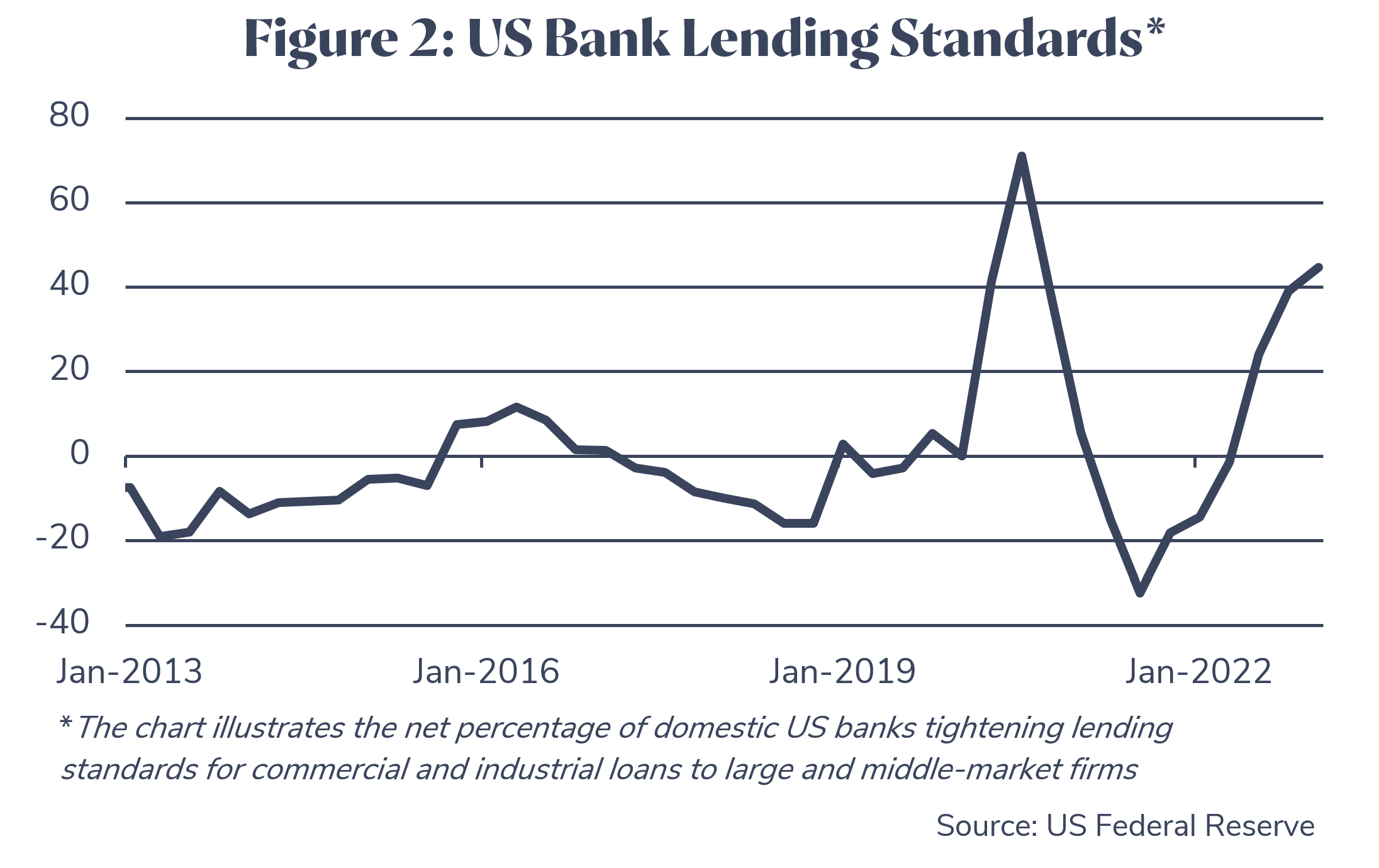

In an attempt to restore confidence and prevent further bank runs, the US Federal Deposit Insurance Corporation (FDIC) fully insured all deposits of the failed banks so far and the US Federal Reserve (Fed) has provided additional liquidity to the banking sector. This has helped to provide some stability in investment markets. That said, US bank lending conditions prior to the recent problems had already tightened to a level consistent with a US recession commencing in 2023 (see Figure 2). These events are likely to reduce the pressure on the Fed to raise interest rates further, with markets now expecting the Fed to reduce interest rates in the second half of the year.

In Australia, the likelihood of bank failures is lower, as Australian banks have stronger capital positions and are subject to more stringent regulations. However, there is a risk that a sharp fall in the housing market eventually results in a recession in Australia. While not our central case, we are monitoring this risk closely.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination.