Global equity markets fell in the quarter ending 30 September 2023 (see Chart 1), following a period of robust performance in the first half of the year. Although inflation in the developed world has fallen from its peak, it is still elevated compared to central banks’ targets. The Federal Reserve and the Reserve Bank of Australia have kept rates on hold at 5.25-5.5% and 4.1% respectively over the last several months but have communicated that further interest rate increases may be required.

A key development in financial markets recently is the sharp rise in US bond yields. The US 10-year bond yield has reached 16-year highs (see Chart 2), putting downward pressure on equities during the September quarter. As bond prices are inversely related to bond yields, bond prices fell sharply during the quarter.

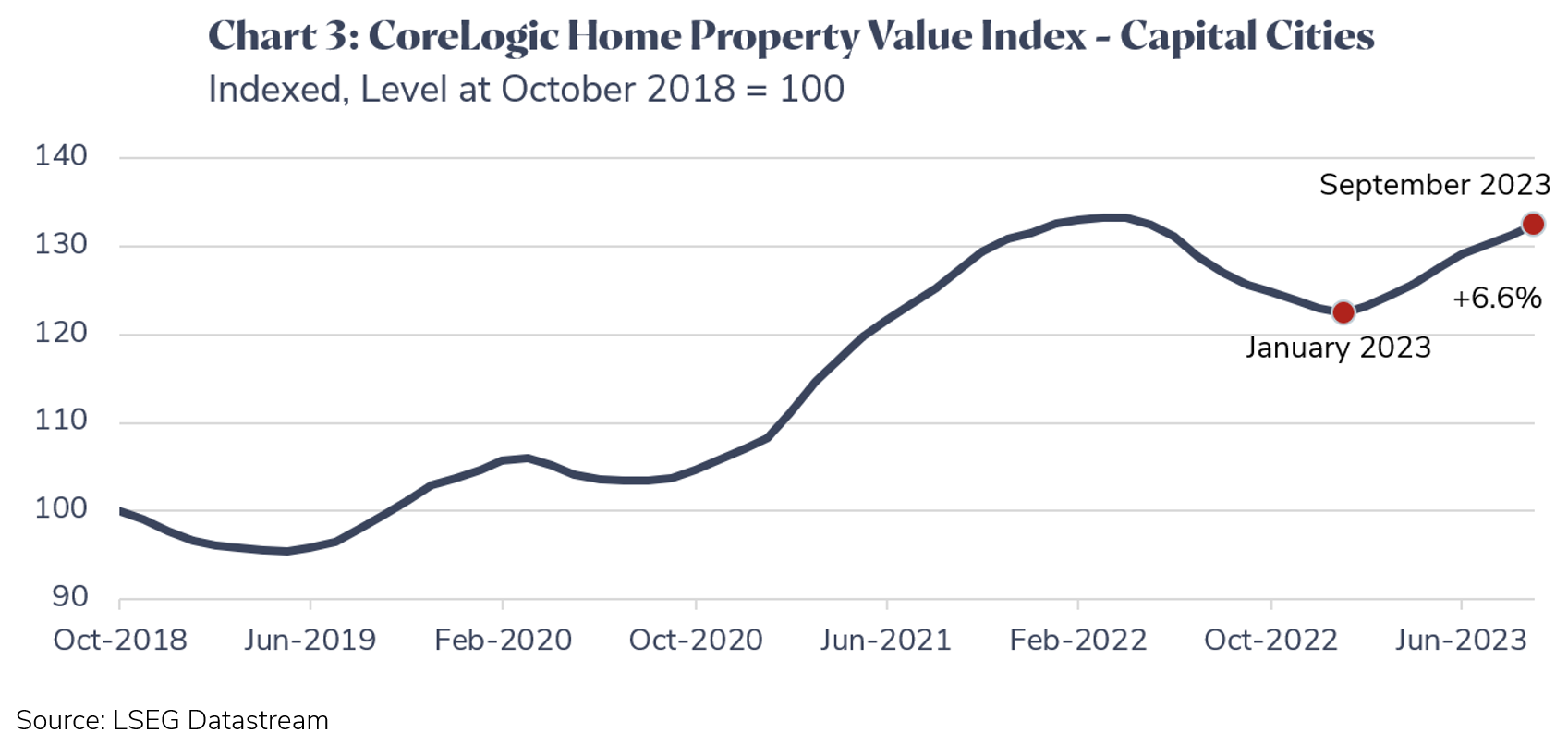

The labour market in Australia remains tight but our leading indicators suggest a slowing in employment growth over the next six months. House prices across Australia’s capital cities have increased by 6.6% since they troughed in January this year and grew 2.2% over the September quarter (see Chart 3). Factors which have supported the rise in prices include a shortage in housing supply, a tight rental market and high levels of immigration.

The Chinese economy is weak and faces material medium-term headwinds due to problems in its property and infrastructure sectors. A couple of large Chinese property developers, Country Garden and Evergrande, are facing severe financial stress from high levels of property inventory, coupled with less demand from an ageing domestic population. The scope for meaningful stimulus by policymakers is less than previously because of high debt levels and over-building.

Weak Chinese growth has also contributed to a 2.6% decline in the Australian dollar relative to the United States dollar over the quarter. Other factors contributing to a weaker Australian dollar include moderately lower interest rates in Australia and a stronger US economy.

Outlook

At the time of writing, a tragic conflict in the Middle East is unfolding. The implications for the global economy are unclear at this stage. Historically, most geo-political events tend to pass within a few months from an investment market perspective. However, there is a risk of a larger and more enduring impact on investment markets from the current conflict.

Our leading indicators suggest the risk of a US recession in the next 12 months is high. US equity market valuations are elevated and risk aversion is moderate. We anticipate a material deterioration in the US economy as the full impact of interest rate rises is progressively transmitted to the economy. The key upside risk to our central case in a more resilient US economy and inflation quickly subsides to a benign level. The main downside risk is a deeper-than-anticipated US recession.

In Australia, a recession in the next 12 months is not our central case, but the risk of such an outcome has increased. While the housing market appears resilient, risks remain around expiring fixed rate home loans and high levels of household debt. Additionally, household consumption growth is weak, increasing by just 0.1% in the June quarter 2023.

We are cautious on the medium-term investment outlook. Reflecting this, our multi-asset class investment options are underweight growth assets such as equities and more constructive on defensive assets such as bonds and cash.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination at www.visionsuper.com.au.