Property and Infrastructure

The Property and Infrastructure investment options are closing following the final trade window in August.

These options will close on the 4th of October 2024. If you’re not invested in these options, there’s no need to do anything – your investment options will be unaffected and your money will remain invested as it is now.

If you are invested in either the Property and/or Infrastructure options, keep an eye out on your letterbox (digital or postal) as you will receive additional correspondence from us to help you make an informed decision.

Balanced low cost fee structure change

The Balanced low cost investment option no longer invests in either the unlisted property or infrastructure asset classes. As a result, the estimated fees and costs of this option have fallen.

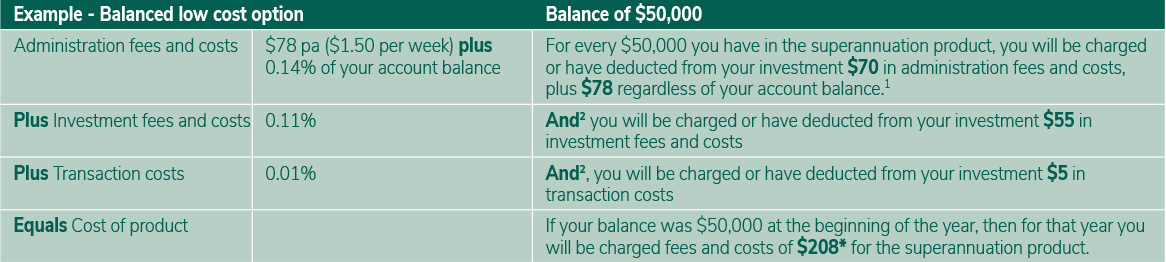

The table below gives an example of how the fees and costs for the Balanced low cost investment option with a $50,000 account balance can affect your superannuation investment over a one year period. You can use this table to compare this product with other superannuation products.

The Investment fees and costs and the transaction costs shown above are estimates of the amounts that you will incur, based on information provided by our investment managers and custodian. These amounts include actual amounts where available and some estimated components. For the year ending 30 June 2023, the Balanced low cost option’s investment fees and costs (including performance fees) were 0.16% (including performance fees of 0.00%) and transaction costs were 0.17%. However, these are not considered reasonable estimates of the ongoing annual investment fees and costs for this option due to changes to the strategic asset allocation (SAA) taking effect on 1 July 2024. Estimates for the year ending 30 June 2025 are shown in the table above.

*Additional fees may apply.

1 Administration fees and costs are comprised of a flat fee of $78 (regardless of your account balance) plus a % based fee, which is $70 for every $50,000 you have in the superannuation product, up to a maximum of $540.

2 For every $50,000 you have in the superannuation product Investment fees and costs and Transaction costs will also apply.

Other fees and costs and fee alterations

Refer to the relevant fees and costs guide for further information.

TTR changes

We have recently made changes relating to opening a Transition to retirement (TTR) or Non Commutable Account Based Pension (NCAP). From 1 July 2024, we will only accept one application for a Non Commutable Account Based Pension (NCAP) from a member each financial year, unless:

- the Trustee otherwise approves your application for an additional NCAP in a financial year, or

- you have received financial advice that it is in your best financial interest to establish more than one NCAP in a financial year.

This means that if you commence an NCAP after 1 July 2024, without Trustee approval you will not (usually) be able to commence another until the next financial year.

It’s important to note that if you currently hold multiple NCAPs, this rule change does not mean you cannot continue to hold multiple NCAPs. It does not impact your current NCAP arrangement in place and does not change the amount or frequency of your payments.

If you have questions, please click here.

Introducing the Vision Super retirement wage

The Vision Super retirement wage is a yearly calculation (annual retirement wage calculation) that is available to Vision Super Account based pension members. This is intended to provide you with an estimate of the level of pension payments (income level) you could elect to receive from your Vision Super Account based pension within a specified financial year.

The annual retirement wage calculation is based on:

- Three components of your pension account (your account balance, your age, and your investment option(s)) as at the previous 30 June

- Certain assumptions including how long your pension is expected to last, including the life expectancy of a person with your date of birth.

The retirement wage calculation will be sent to members for the first time in July 2025.

1 July PDS updates

These changes, along with updates to the Super Guarantee (SG) and contribution rates have been made to the Fund’s PDS effective 1 July 2024. There are also changes to our Strategic Asset Allocations for a number of our investment options. To find out more, you can read our updated PDSs here: https://www.visionsuper.com.au/product-disclosure-statements/