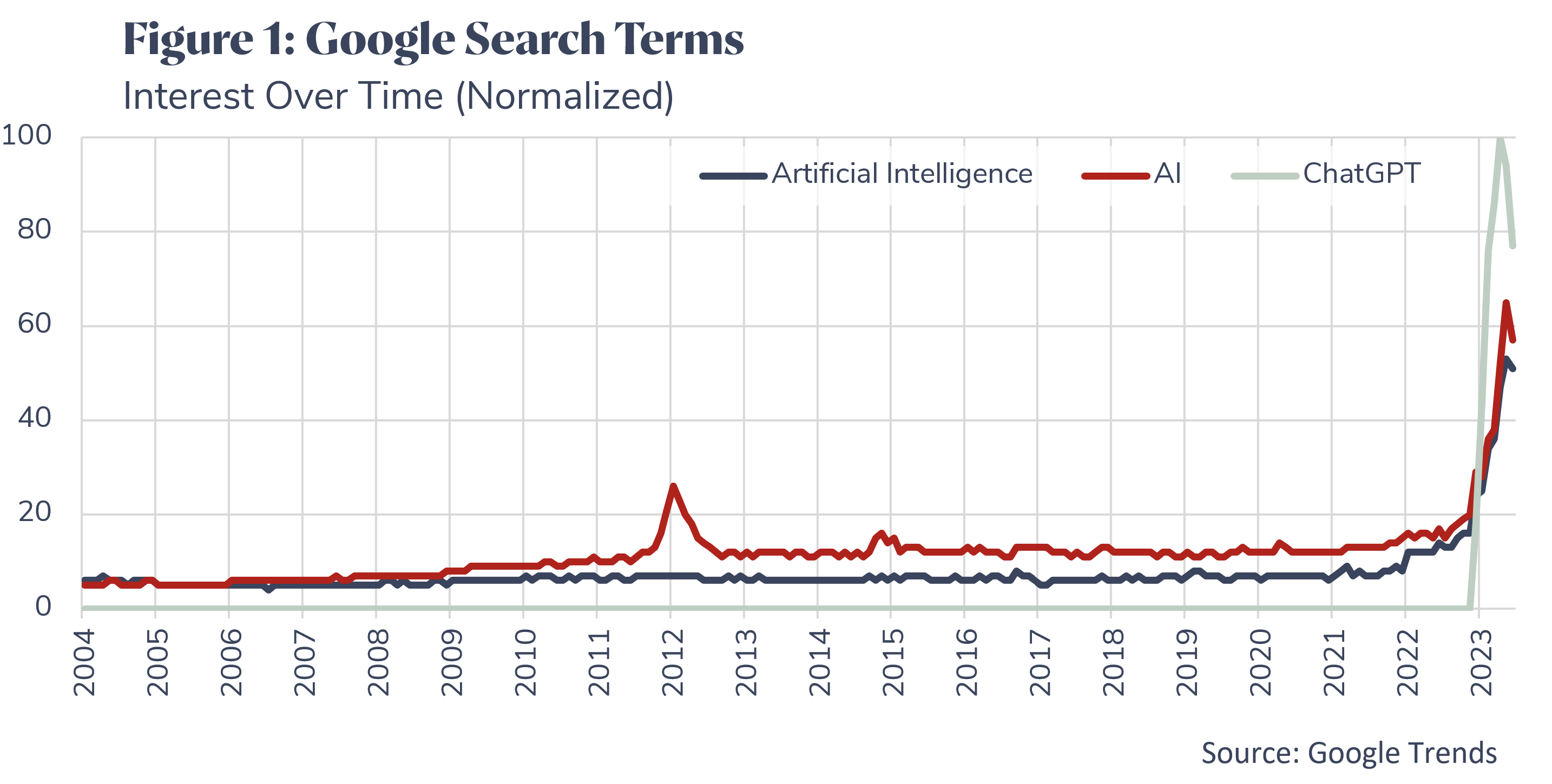

Following significant losses during 2022, the US stock market has rallied recently. The rally has been led by technology companies, supported by the growing excitement surrounding artificial intelligence (AI). The chart below (based on Google searches) shows a dramatic increase in the interest in AI over recent months.

While AI is not a new concept, the recent development of generative AI may provide a material boost to productivity over the medium term. Generative AI involves “training” software on a designated set of data, which can be very large. Following the “training” phase, some generative AI software will respond to requests to create outputs such as text, images, videos, and audio. While there are a range of issues with some of the responses (eg. errors), they tend to be far better than those produced by AI in the past.

ChatGPT, a generative AI capability, has captured the attention of investors since its release on 30 November 2022. It was initially launched as a free software. With new versions of the software being more sophisticated and saleable, the latest version is not free. Despite this, the take-up rate has been exceptionally fast versus most other software.

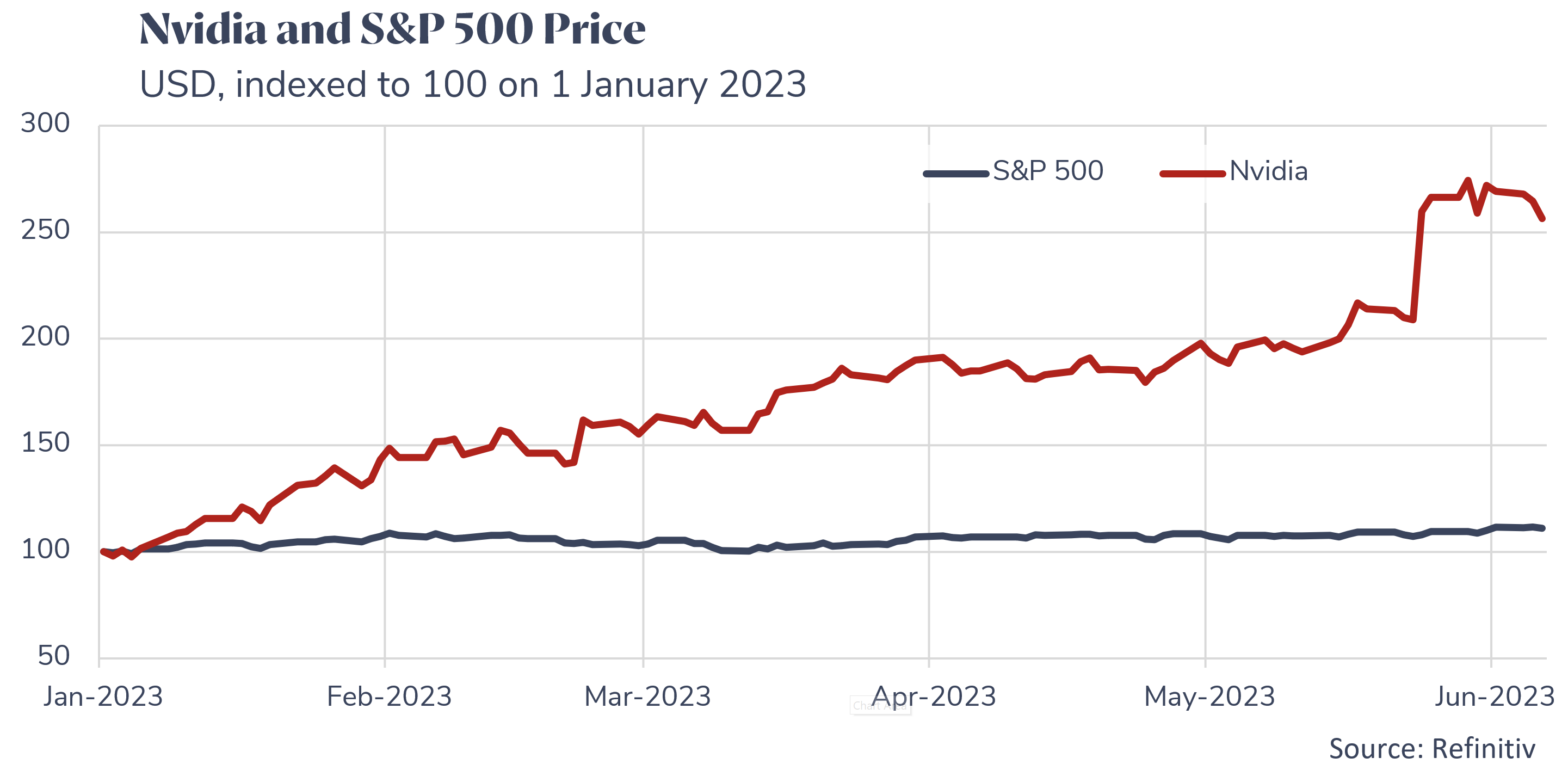

While generative AI is likely to increase productivity, uncertainties and risks accompany its adoption. While it is difficult to know the impact of AI on employment with any precision, it appears likely it will become an increasingly important tool that may displace some activities but also create opportunities. It is difficult to know which companies will benefit the most from generative AI. Companies such as Nvidia have experienced substantial increases in their stock prices recently due to their involvement in the AI supply chain. Nvidia is a key supplier of AI hardware and software. For example, its processors can be used to “train” generative AI software.

The recent surge in some AI-related stock prices reflects the expected growth of profits of the respective companies. Valuations of some of these companies have reached very elevated levels, implying that investors are already factoring in high rates of profit growth. Some analysts draw parallels to the dot-com era, highlighting the challenges faced by AI, including ethical concerns and quality of data. While generative AI seems likely to provide a material increase in productivity(1), the extent and timing of the benefits are uncertain. What we do know is that fear of being outcompeted will drive companies and nations to invest extensively in this area.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determinations.